arizona solar tax credit 2019

The credit amount allowed against the taxpayers personal income tax is. The Consolidated Appropriations Act of 2021 bill extended the 26 investment tax credit through 2022.

Heliostat Solar Tracking Mirror Light Into Solar Prism And Rainbow Light Art Installation Erskine Solar Art Light Art Light Art Installation Solar

Read User Reviews See Our 1 Pick.

. Arizona state tax credit for solar The most significant solar rebate offered in Arizona is the Credit for Solar Energy Devices from the Arizona Department of Revenue. Content updated daily for arizona solar tax credit. Tax Incentives For Solar Conversion AZ Convert To Solar And Save Phone.

Ad Check Out Our Wide Variety Of Inventory From Charge Controllers To Inverters To Panels. Enter Your Zip Find Out How Much You Might Save. Enter Your Zip Find Out How Much You Might Save.

See Ratings Compare. Here are the specifics. Income tax credits are equal to 30 or 35 of the investment amount.

Ad This is the newest place to search delivering top results from across the web. Likewise a taxpayer can make a 5 donation record this gift on Arizona Form. Ad Find The Best Solar Providers In Arizona.

A single taxpayer who wants to contribute 400 to a QCO and claim the maximum allowable credit may do so. Your Name as shown on Form 140 140PY or 140X Your Social Security Number Spouses Name as shown on Form 140 140PY or 140X if a joint return Spouses Social Security Number Part. Arizona offers state solar tax credits -- 25 of the total system cost up to 1000.

Systems installed before December 31 2019 were eligible for a 30 tax credit The tax credit expires starting in 2024 unless Congress renews it. Arizona Residential Solar and Wind Energy Systems Tax Credit. Ad Find The Best Solar Providers In Arizona.

Ad A Comparison List Of Top Solar Power Companies Side By Side. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system. A nonrefundable individual tax credit for an individual who installs a solar energy device in taxpayers residence located in.

If you lived alone your total. As a credit you take the amount directly off your tax payment rather than as a deduction from your taxable. Arizona Residential Solar Energy Tax Credit Buy new solar panels in Arizona and get a 25 credit of its total cost against your personal income taxes owed in that year.

The Arizona Commerce Authority ACA administers the Qualified Small Business Capital Investment program. This incentive is an Arizona personal tax credit. Tax Incentives For Solar Conversion AZ Convert To Solar And Save Phone.

6 The maximum credit in. Here are some of the best opportunities to go solar and save money. Arizona solar tax credit Every resident in Arizona who installs solar panels gets a State Tax Credit of 25 of the total system cost up to 1000 to be used toward State income taxes.

The tax credit remains at 30 percent. Bitly2UO9Nyq If you are thinking about going solar now is the time to do it. There is no maximum amount that can be.

23 rows Did you install solar panels on your house. Residential Arizona Solar Tax Credit Homeowners are reimbursed 25 percent of the cost of solar panels. You paid property tax on your Arizona home OR paid rent on taxable property for the entire year.

You were a full year resident of Arizona for the current tax year. See all our Solar Incentives by State All Arizonians can take advantage of the 26 Federal Tax Credit which will allow you to recoup 26 of your equipment AND installation. Shop Northern Arizona Wind Sun for Low Prices Free Ground Shipping For Orders 500.

See Ratings Compare. Find The Best Option. 2022s Top Solar Power Companies.

The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system.

2019 Pennsylvania Home Solar Incentives Rebates And Tax Credits Tax Credits Incentive Pennsylvania

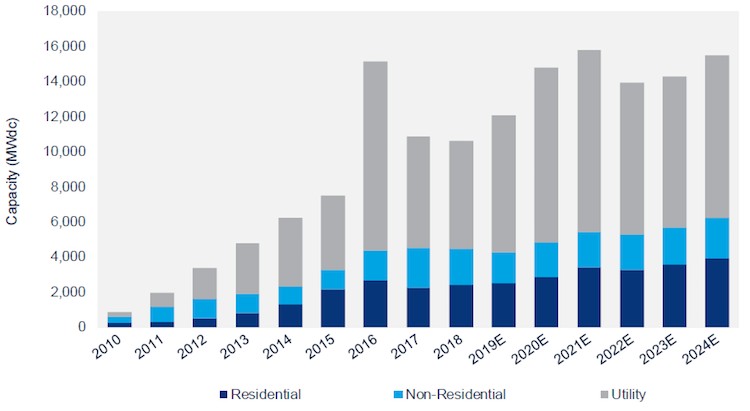

Southeast Us Adds 427 Mw Of Distributed Solar In 2019 As Advocates Press For More Pv Magazine Usa Energy Plan Solar News Solar Program

Solar Tax Credit 2021 Extension What You Need To Know Energysage

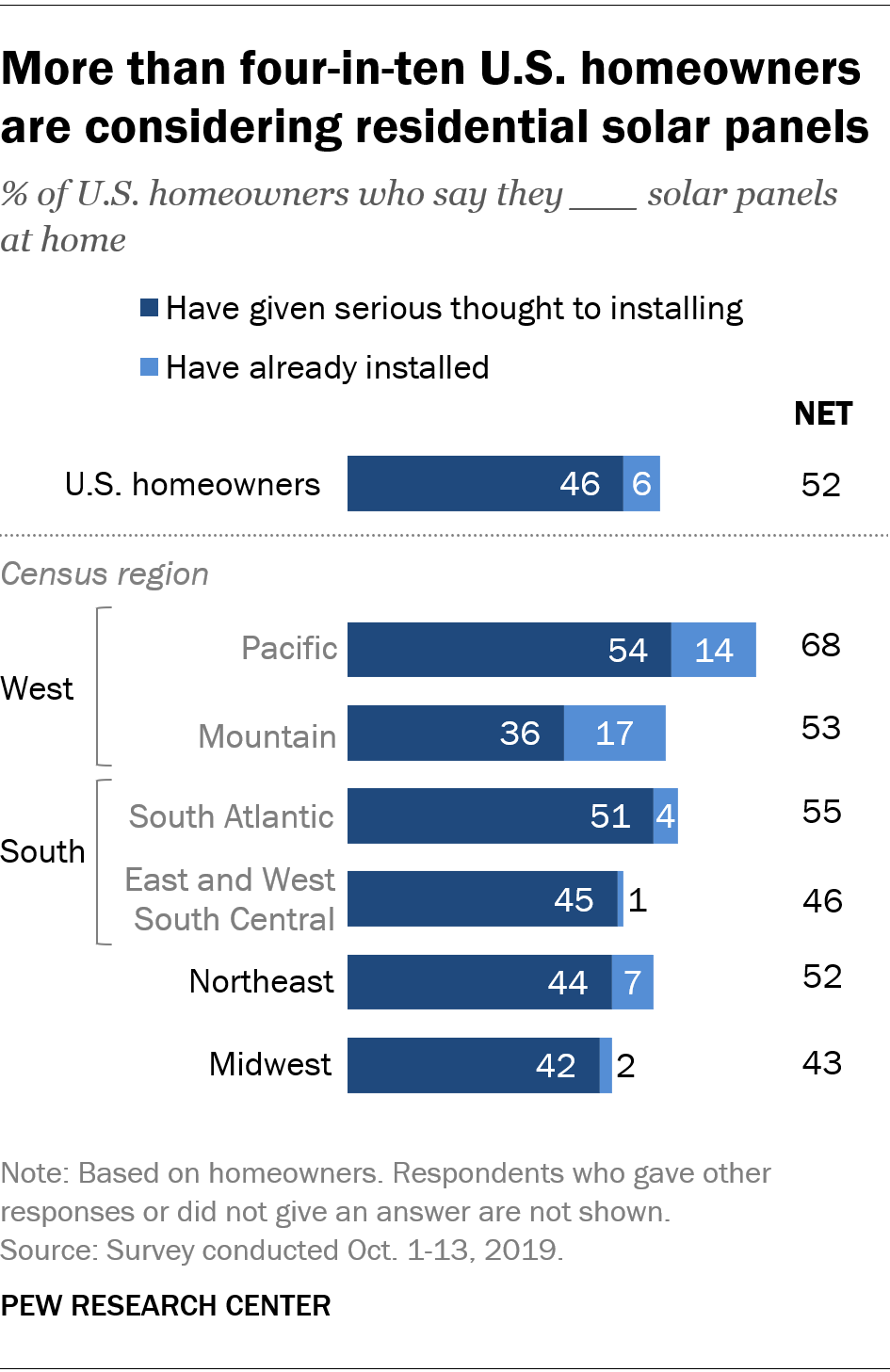

More U S Homeowners Say They Are Considering Home Solar Panels Pew Research Center

10 Fintech Trends To Watch In 2019 Fintech Technology Trends Infographic

Pin By Solar Electric Power Company On A Light For All Solar Energy Climate Reality Solar Energy Solar

2013 And 2016 Energy Code Infographic Energyefficient Energyefficiency Caenergy Energy Efficiency 30 Year Mortgage Energy

How Much Do Commercial Solar Panels Cost Kake

How To Calculate The Federal Solar Investment Tax Credit Duke Energy Sustainable Solutions

The Ultimate 2020 Guide To California Solar Tax Credit And Incentives

Energy Solar Power House Solar Energy Panels Solar

30 Renewables Cheaper Natural Gas By 2030 With Res Renew Alternative Energy Renewable Electricity

Solar Panels For Your Mcm Home Cadence Design Studio Solar Solar Panels Pv Panels

Salt River Tubing Fun In The Sun Salt River Tubing Tubing River Fun

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

History Of Solar Power Solar Energy Explosion Timeline

Solar Tax Credit In 2021 Southface Solar Electric Az